You just finished the 2019 tax compliance season and thought that you had conquered all the 2020 tax hurdles. Unfortunately, there may be one additional obstacle for you to consider. Form 1099, a tax form that is becoming more and more common in today’s economy, is receiving some key changes for the 2020 tax year. The three changes to Form 1099 relate to updates to the form itself, increased reporting complexities / consequences and changes within the IRS.

As a refresher, Form 1099 is the tax record certain individuals receive from an entity or person summarizing earnings for the year. A person receives a 1099, rather than Form W-2, when they are considered an “independent contractor” instead of an employee. Form 1099-MISC is one of the most common 1099 forms and should be issued for each person that has received one of the following from an entity or person:

- At least $600 in services, rents, prizes or awards and other income payments.

- At least $10 in royalties or broker payments in lieu of dividends of tax-exempt interest.

- Gross proceeds to an attorney.

Remember how I said this form is becoming more common for businesses to issue? That’s because, in today’s economy, companies are increasingly turning to independent contractors (1099 recipients) rather than full-time employees (W-2 recipients). Employee benefit packages are becoming extremely costly for employers, so hiring an independent contractor is a tactic that many businesses are utilizing to lessen the burden of benefit package costs. I encourage you to look at your payroll and compare it to 10 years ago. You may be surprised by how much of your payroll has shifted from full-time employees to hourly contractors.

Exploring the 3 Main Changes to Form 1099

Change #1: Modifications to the 1099 form

Have you ever taken the time to get familiar with Form 1099-MISC? As a refresher, on the form, you will see various information displayed, such as rents and royalties. Box 7 (Non-employee Compensation) is the major catalyst for the recent reporting deadline change to the 1099 form. The deadline to report non-employee compensation will be January 31, 2021, while 1099-MISC forms without non-employee compensation will be due either February 28, 2021, for paper file or March 31, 2021, for e-file.

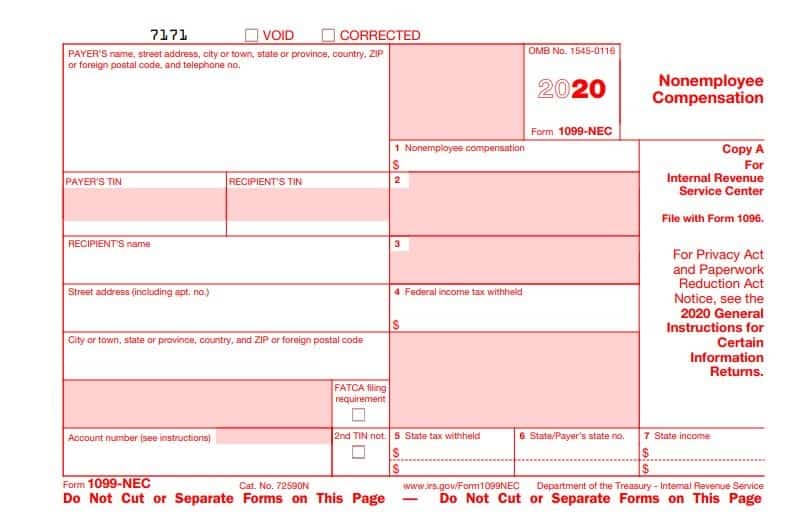

The difference in reporting deadlines can be attributed to the Protecting Americans from Tax Hikes (PATH) Act of 2015, which required 1099-MISC forms reporting non-employee compensation to be expedited. This created a situation where the Internal Revenue Service (IRS) might inadvertently treat forms without non-employee compensation as late returns if not submitted by January 31. To remedy this issue, on July 24, 2019, the IRS resurrected Form 1099-NEC. Form 1099-NEC, a form that hasn’t been used since 1982, will be used to report non-employee compensation items. The reason for this action is that by separately reporting non-employee compensation information that has an earlier due date, there will be less chance for errors.

Instructions to the 2020 Form 1099-MISC and 1099-NEC can be found here.

The 2020 1099-NEC (used for Nonemployee Compensation)

Change #2: Increased reporting complexities and consequences

With a new form now required to be filed, many people are asking what income items are supposed to be reported on Form 1099-NEC. The IRS had laid out the following conditions that need to be met for a payment to be considered as non-employee compensation:

- You made the payment to someone who is not your employee.

- You made the payment for services in the course of your trade or business (including government agencies and non-profit organizations).

- You made the payment to an individual, partnership, estate, or, in some cases, a corporation.

- You made payments to the payee of at least $600 during the year.

It is clear that with the expedited due date for non-employee compensation, your business will have to devise a plan on how to handle this reporting before considering reporting on other compensation presented on the 1099-MISC.

Despite all of these changes, the IRS has continued to increase penalties for untimely reporting. Tax filers will have a $50 penalty applied for information returns filed after the deadline but within 30 days. The penalties increase to $110 for returns filed after 30 days beyond the deadline but before August 1, 2021. Information returns filed after August 1, 2021, will incur a penalty of $270 per form, and information returns not filed with intentional disregard will incur a penalty of $550 per return.

Change #3: Updates within the IRS

We should expect now more than ever for 1099 forms to come under scrutiny as all these changes are instituted. According to the Taxpayer Advocacy Group, it is expected that the IRS will increase enforcement by 5 percent, despite resources at the IRS being extremely thin due to the COVID-19 pandemic. In other words, non-employee compensation will have a new process of reporting and an earlier deadline than ever before, all while there are fewer resources to assist at the IRS.

What You Can Do Now

While your head may be spinning with all these changes, there are a couple of action items that you can take now to prepare for the 2020 updates to the 1099:

- 1.) Talk to your tax advisor and see if there are ways to expedite the reporting of items that pertain to non-employee compensation. Remember, this has the earlier January 31, 2021 deadline.

- 2.) Make sure you and your tax advisor are paying close attention to the guidance the IRS issues. It is expected that 2021 will bring more clarity to the new form(s).

If you have further questions on the changes to the 1099 forms, Moore Colson’s Tax Practice is available to help. Please contact us so we can strategize on the best approach for your business.

0 Comments